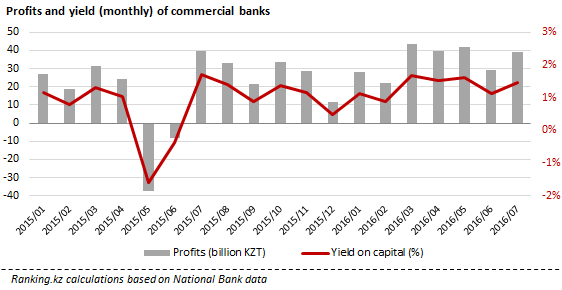

In July 2016 the banking sector somewhat reduced their profits – banks raised profits worth KZT39.3bn against KZT39.8bn a year earlier. Banks’ net profits totalled KZT243.8bn since the beginning of the year, or almost 160% more year on year.

In 2015-16 monthly return on capital didn’t exceed 2% - the highest level was recorded in July 2015 (1.7%). Total capital in the sector grew by 14.7% year on year in July; as a result, the combined yield on capital of commercial banks did not reach 1.5% - it stood at 1.47% in July 2016.

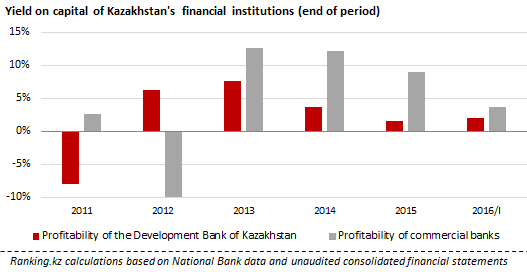

As a whole, the financial system showed mixing results for long-term indicators of profitability. Most commercial banks followed a steady downward trend, while the Development Bank of Kazakhstan, the main source of funding for national projects, managed to increase profitability in the first quarter of 2016, exceeding yield in the entire 2015 and reaching 2.1%, which is only 0.9 percentage points below the strategic target set for 2016.

The Development Bank’s yield on capital grew on the back of intensive growth in capital as the bank increased its capital by 15.8% compared to 2014, whereas commercial banks’ capital grew by only 8.9% in the same period.

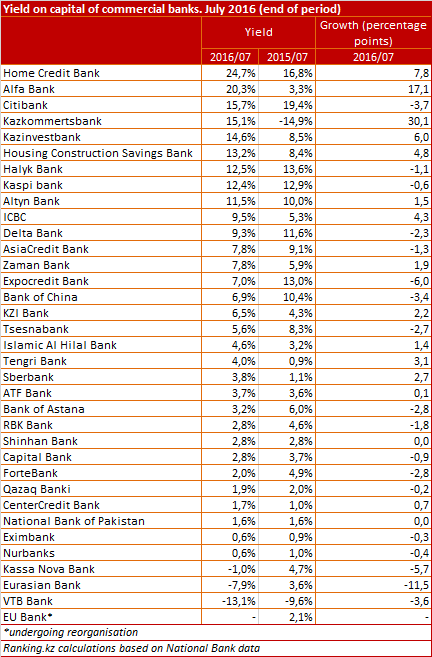

In terms of yield on capital in the first seven months of 2016 the leader among all commercial banks was Home Credit Bank (along with Alfa Bank, it is the only bank with a yield of over 20%). Among the top three the most profitable bank was another bank with foreign capital – Citibank. The first bank with purely Kazakh capital was Kazkommertsbank which came fourth, showing the highest growth in yield on capital (thanks to recover after losses resulting from its acquisition of BTA Bank in 2015).